Japanese re-selling of Australian LNG

27 August 2024

Background

In March 2024, the Institute for Energy Economics and Financial Analysis (IEEFA) published a report analysing the current and projected positions of Japanese gas companies with respect to supplies of liquefied natural gas (LNG). The report found that utility companies like JERA, Tokyo Gas and Osaka Gas face a surplus of LNG in the coming years, due to the large number of long-term supply deals which they have entered into.

Citing a market survey by Japanese regulator JOGMEC, IEEFA analysts pointed out that Japanese buyers are already doing a brisk trade re-selling LNG volumes where these are contractually available to them without destination restrictions, as well as participating in the spot market. This analysis was expanded in a follow-up article looking directly at Australia, in response to a claim by the Japanese ambassador that Australian gas is needed to keep "the neon lights of Tokyo [from] ever going out".

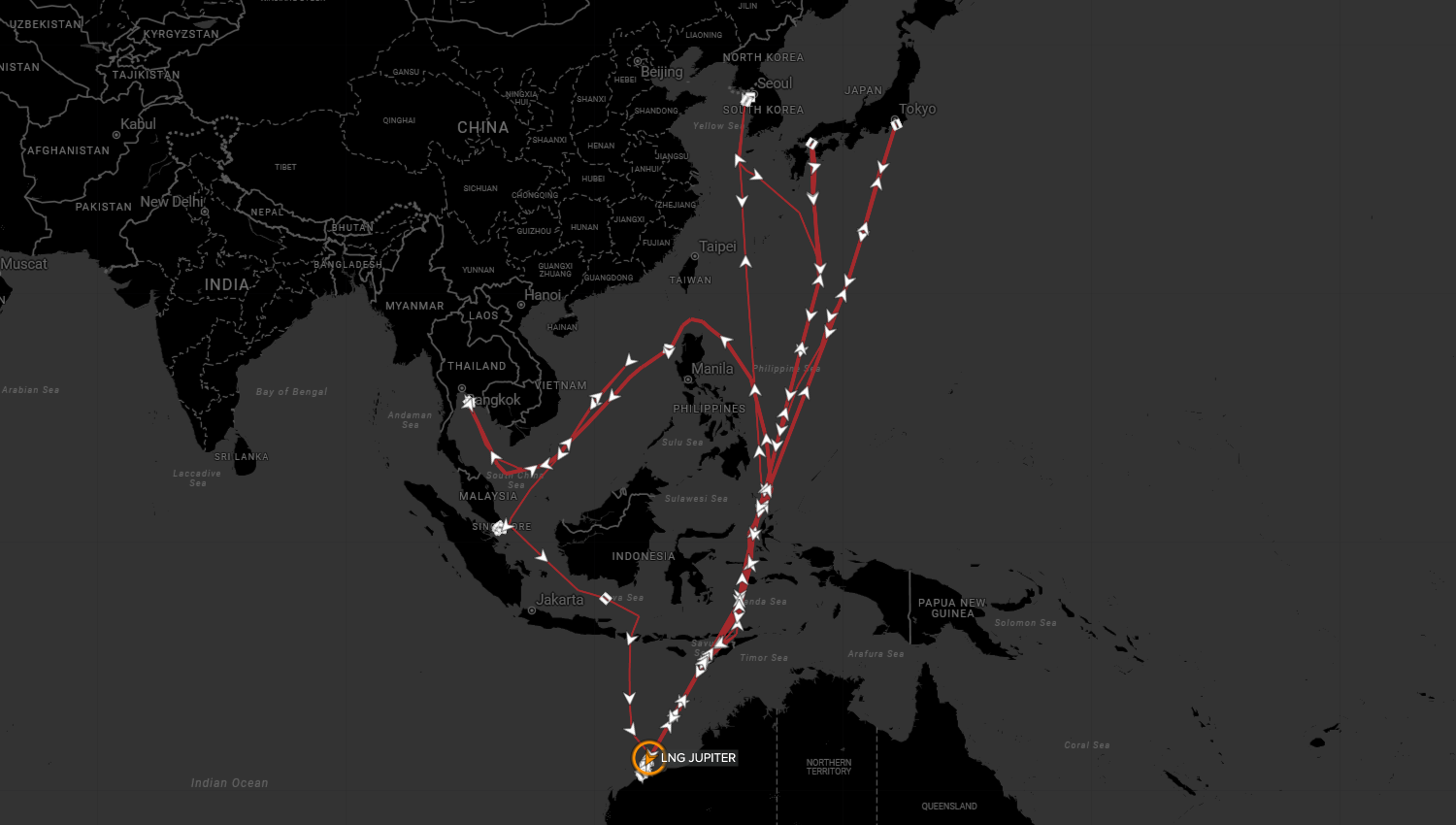

In this context, journalists have made a link between surplus contracted volumes of LNG held by Japanese buyers and the country's energy diplomacy, which has encouraged the build-out of LNG receiving infrastructure and gas-fired power generation in Southeast Asia. Data Desk was asked by Jubilee Australia to analyse this dynamic in more detail, with the aim of identifying significant flows from Australia, via Japanese buyers, to countries where the Japan Bank for International Cooperation (JBIC) has funded major gas infrastructure projects.

Analysis of LNG flows

According to a JOGMEC survey of 30 Japanese companies, around 32 million tonnes (Mt) of LNG was sold to third countries by Japanese buyers in the 2022 financial year. The sources of this gas are roughly evenly split between gas procured through term contracts and the spot market on the one hand, and gas to which Japanese companies have access through direct participation in upstream energy projects on the other. These figures have remained relatively consistent since 2019.

Data sources

In order to identify the LNG shipments making up these total numbers, we used the following data:

-

a global LNG flows model provided by the London Stock Exchange Group (LSEG), which incorporates vessel movements, customs filings and information from market participants, among other sources;

-

a database of active long-term contracts between LNG projects and buyers, also provided by LSEG; and

-

published information on the building of new tankers for Japanese companies and long-term chartering arrangements with shipping lines, largely from the trade press and corporate press releases.

To assess Japanese involvement in destination countries' energy sectors, we used analysis from a recent Reuters article and Oil Change International's (OCI) Public Finance for Energy Database.

Methodology

First, we created a dataset consisting of shipments from Australia to Bangladesh, India, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Taiwan, Thailand and Vietnam — all countries where Japanese institutions and companies have supported gas demand through infrastructure build-out.

We then cross-referenced the Australian origin ports with the loading ports for specific LNG projects, filtering the dataset to shipments where Japanese companies hold contracts to ship significant volumes without destination restrictions. Finally, we zeroed in on shipments carried out by tankers which credible sources indicated were controlled by Japanese companies.

Conclusion

From this analysis, which is necessarily partial due to the limited availability of LNG tanker chartering information, two major destination countries emerged — Thailand and Taiwan — with a smaller number of shipments also going to Indonesia. While the data quality is not sufficient to specify total volumes, Thailand and Taiwan each appear to receive at least 10 shipments from Australia by Japanese buyers each year.

Starting with OCI's data on public subsidies, we researched public and private funding for energy infrastructure in both countries and found that Japanese involvement in the construction of gas demand in Thailand is much more significant than in Taiwan, as described below.

Case study: Map Ta Phut

Japanese companies have contributed significantly to the creation of gas demand in Thailand, both through the construction of new power plants and through support for LNG import infrastructure itself, despite warnings from local groups that Thailand's power sector faces chronic overcapacity.

The key location is the port of Map Ta Phut near Rayong, the site of a large petrochemicals-focussed industrial park, an oil terminal and tank storage facility, two LNG import terminals and a coal-fired power station and associated loading facilities.

LNG terminals

Useful summaries of the first two LNG terminals constructed at Map Ta Phut can be found on the Global Energy Monitor wiki.

The first terminal is situated on an existing piece of reclaimed land next to a coal-fired power station (which, incidentally, relies on imported Australian coal), and was commissioned in 2011. The second phase involved a new pier built to the west of the existing facility and came online in 2022. In between these two sites, yet another import terminal is currently under construction.

Engineering work on the first terminal was carried out by Tokyo Gas, with the company subsequently being awarded a project management consultancy (PMC) contract for the second terminal, also known as the Nong Fab terminal. A good summary of the company's involvement is available in this press release from 2018.

Power plants

Two nearby power plants, known as Gulf SRC and Gulf PD, were funded by a combined $435 million in loans from JBIC, in addition to co-financing from Mizuho Bank and Sumitomo Mitsui Trust Bank (Gulf SRC; Gulf PD). The power plants are jointly owned by Mitsui & Co. and a local developer and were built under contract by Mitsubishi Hitachi Power Systems, which continues to have a role in operating the plants.

While the availability of geospatial data on Thai gas distribution networks is limited, we have georeferenced a high-level map of pipeline infrastructure in the region published by PTT and determined that both plants are located within the dense network of pipelines heading north from the Map Ta Phut terminal.

Community impact

A summary of the terminal's impact on local people is provided in a recent press release by Friends of the Earth Japan:

In Rayong Province, Thailand, fisherfolk communities have expressed concerns over the livelihood impacts of an LNG import terminal situated in Map Ta Phut. This terminal, which supplies a JBIC-financed power plant, is adversely affecting biodiversity and various species of sea animals crucial for food supplies and the local economy, while communities are left behind without fair compensation.

Further information has been provided by Manop Sanit, an environmental activist who serves as Rayong Clean Energy Coordinator:

We are under 'Development discourse' which has a group of people benefiting and groups that are affected or at a disadvantaged position. People in Rayong province often say that we have to sacrifice for 'development' but 'development' offered them nothing but dismay. People['s] livelihood[s] as fishermen have totally changed. And I don't know if there will be anyone who will carry on this tradition or not.

During the development of Eastern Seaboard, the locals were faced with projects from reclamation of the sea to the construction of the port in Map Ta Phut. Measures to convert agricultural land into industrial area were put in place. EEC [Eastern Economic Corridor] encroached into the seaside areas [and] caused negative impact on the livelihood of local fishermen as [the] area for fishing became limited.

The LNG import terminal in Map Ta Phut has immensely affected the fishery community resulting in the loss of their livelihood. Biodiversity and diverse species of sea animals which are an important source of food and local economy have been destroyed. Yet, there has never been any compensation for the way of life and the natural resources lost. Communities had to stand up and fight to demand fair compensation. This really shows that these projects go against the quality of life of Rayong people.

Compensations were never offered. It has never happened since the reclamation of Map Ta Phut from Phase 1, Phase 2, to Phase 3. The problems fisherfolks have been facing that affected their way of life, their living area, have never been resolved. Fisherfolk community had to stand up and fight to demand fair compensation for themselves.

The Global Atlas of Environmental Justice gives further background on conflicts in the area related to development of the port and associated industrial zone.

Example shipment

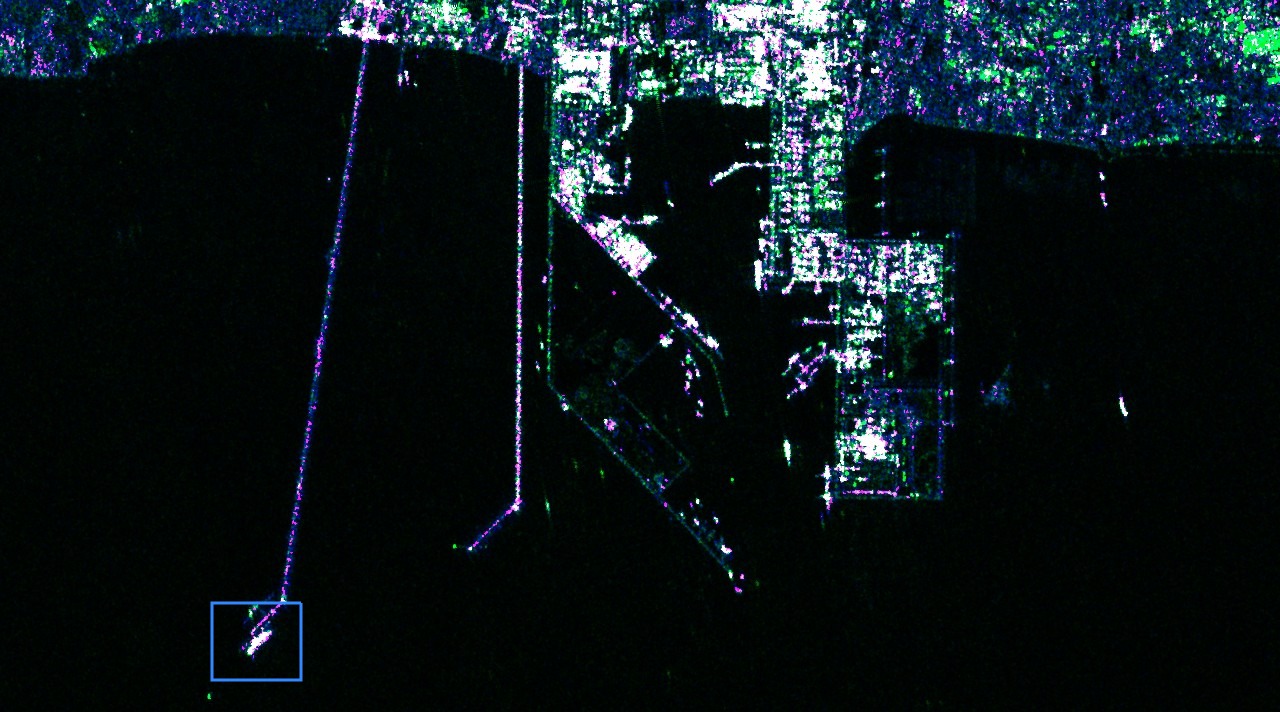

The most recent shipment to Map Ta Phut that we can conclusively link to a Japanese company occured in March 2024, when the LNG Jupiter (IMO 9341689) delivered a cargo from the North West Shelf project in Australia to the Map Ta Phut Phase 2 terminal. A 22 March synthetic aperture radar (SAR) image from the ESA Sentinel-1 satellite shows the tanker docking at the terminal.

As of 31 March 2023, the LNG Jupiter was listed (p. 8) as part of a fleet controlled by Daigas Group, the parent company of Osaka Gas. According to LSEG's LNG contracts database, Osaka Gas has the right to lift one million tonnes per annum of LNG from the North West Shelf project.

Reaction quotes

A draft version of this analysis was shared with relevant NGO experts for comment.

Sam Reynolds, research lead for IEEFA's Asian gas programme, said:

Japanese companies and financiers continue to develop large LNG projects around the world, claiming that LNG expansion is necessary for Japan’s own energy security. However, the country’s LNG demand peaked a decade ago, and government data shows that domestic companies are increasingly re-selling excess LNG volumes overseas for profit.

This report provides clear examples of Japan’s LNG resale activities and infrastructure projects in Asia, shedding light on the influence of Japanese companies in regional energy sector developments. Clearly, Japan’s support for LNG is less about domestic energy security and more about locking in fossil fuel business opportunities for decades to come.

Mia Watanabe, a campaigner at Oil Change International, said:

This is a clear example of Japan deceiving its neighbours and sacrificing regional energy security in order to generate huge profits for Japanese corporations. Japan’s onselling of gas to third countries hampers their development by locking them into decades of outdated, polluting fossil fuels. From upstream to downstream, Japan is aggressively pushing for new gas infrastructure at a time when it should instead be using public funds to support cheap, locally produced, renewable energy projects.