Israeli crude and fuel supply chains

8 March 2024

This document is a background supply chain analysis for Oil Change International (OCI) provided by Data Desk. It should only be cited after quotes are checked with OCI or Data Desk. Permission must be sought from the relevant copyright holders before reproducing satellite imagery.

Data sources

The main sources used for this analysis are: Automatic Identification System (AIS) data on ship positions and aggregated commodity trade flows data from LSEG's CARGO app; customs filings and bills of lading from Sinoimex Global Trade Monitor; and satellite imagery from Planet Labs and the ESA Sentinel-2 satellite. While detailed examples and evidence are provided only for the most significant flows in volume terms, Data Desk can provide more detailed information on the other flows mentioned on request.

Data from LSEG's CARGO app represents a best-guess model of the global seaborne trade in oil and refined products, based on AIS data, databases of refineries and oil loading and discharge ports, tanker fixtures, port line-ups, information from market participants and expert analysis. Shipments identified in this data must be cross-referenced with data from other sources (e.g. trade records and satellite imagery) before being referred to in published outputs.

Israel's oil infrastructure

Israel imports crude oil to feed refineries at Ashdod and Haifa. It also imports refined products, which are consumed domestically as fuel and in some cases re-exported, taking advantage of the country's strategic location at the northern end of the Suez Canal. The key ports for deliveries of both crude oil and refined products are Ashkelon, Ashdod and Haifa. Due to disruption at Ashkelon related to the ongoing Gaza conflict, the port of Eilat — connected to Ashdod by pipeline — has also been used for crude imports in recent months.

Given its regional political isolation, Israel is heavily reliant on seaborne imports, with no pipeline infrastructure connecting the country to its neighbours. As a small country with a relatively large army and air force, there is also significant overlap between civilian and military fuel supply chains in Israel.

For example:

-

Ashdod refinery: According to the Q4 2023 financial report for the Paz Group (p. B-3), its subsidiary Paz Aviation Services holds an active contract to refuel aircraft at seven military airbases in Israel, which appears to cover the majority of the Israeli Air Force estate. According to the same report (p. A-14), Ashdod refinery — which was spun out from the Paz group in October 2023 — produced 262,000 tonnes of jet fuel between January and June 2023, 11% of its overall output.

-

Haifa refinery: Israeli military personnel are permitted to refuel their vehicles at any of around 400 petrol stations owned by the companies Delek and Sonol, under a contract awarded in 2021. According to Sonol's website, fuel for its filling stations is sourced from the Haifa refinery. Details from Delek Group's 2020 annual report (pp. A 281–82) also suggest that it sources fuel for filling stations from the Haifa refinery. In a recent LinkedIn post, the Bazan Group, which owns the Haifa refinery, talks about "provid[ing] continuous energy to vehicles, the military, and the entire energy economy."

Sources of crude oil and feedstocks

Israel's imports of crude oil and feedstocks appear to have been relatively unaffected by current events, relative to imports of refined products. The chart below shows volumes of crude oil imported over time, broken down by broad origin region. With the exception of flows from Iraqi Kurdistan — which were cut off in Spring 2023 due to a dispute between Iraq, the Kurdistan Regional Government and Turkey, unrelated to the war in Gaza — there has been little change over recent months.

The core of Israeli refineries' crude slate is made up of oil from the Caspian Sea region — specifically, crude from Azerbaijan piped through the Baku–Tbilisi–Ceyhan (BTC) pipeline and crude from Kazakhstan and Russia that travels via the Caspian Pipeline Consortium (CPC) route. Between them, these sources have historically accounted for a significant majority of the crude entering Israel each month.

The map below shows the routes of both the BTC pipeline (red), which terminates at the port of Ceyhan in Turkey, and the CPC pipeline (green), which terminates at Novorossiysk on the Russian Black Sea coast, along with typical tanker routes to Israel (dashed white).

In addition to these core regional suppliers, Israel also sources crude from further afield, notably Gabon and offshore Brazil. Gabonese flows do not appear to have been affected by the conflict in Gaza, with five cargoes of crude arriving since 13 October 2023, the date of the first raid by the Israeli military.

Looking at Brazil, Israel has received 260,000 tonnes of crude produced from fields co-owned by Shell and Petrobras since 13 October. The shipments from Brazil — evidence for which is given below — were made via tankers which turned off their AIS transponders in the Port Said STS zone, before reaching Israel.

For example: a tanker called the Freud (IMO 9804461) first loads a cargo of crude in the Santos ship-to-ship transfer zone offshore Brazil on 29 November 2023, clearly visible in the raw AIS data as a change in draught from 9.3 metres to 16.3 metres. The vessel offloading cargo was the shuttle tanker Windsor Knutsen (IMO 9316115). The Freud's last recorded AIS ping before reaching Israel was at 07:57 AM UTC on 21 December 2023, at latitude 31.9886 and longitude 34.1987, heading towards Israel at a speed of 12.6 knots. Its next ping was at 12:22 PM UTC on 27 December 2023, sailing in the opposite direction at 9.4 knots. Shortly after this, its draught is recorded as falling back to 9.3 metres, suggesting that the ship had offloaded cargo.

Between these dates, the tanker appears to have moored at the Europe Asia Pipeline Company (EAPC) terminal south of Ashkelon, from which pipelines supply the Haifa and Ashdod refineries, as indicated in Sentinel-2 satellite imagery.

A more recent delivery on the Milos (IMO 9746619) follows exactly the same pattern, with the ship picking up a cargo via STS (in this case from the Lena Knutsen) and turning off its AIS on 9 February 2023 at around the same distance from the Israeli coast. The ship, with its distinctive pale deck, is easily spotted in the same place as the Freud at the EAPC terminal in a Planet image from the following day.

A much smaller flow appears to come from Saudi Arabia, via the Sumed pipeline.

These flows appear in LSEG's data as shipments from the pipeline's northern terminus at Sidi Kerir, near Alexandria, Egypt. Using its Red Sea ports, Saudi Arabia can export oil north to Israel without having to send ships through the Gulf of Aden. These flows appear in LSEG's data as shipments from the pipeline's northern terminus at Sidi Kerir, near Alexandria, Egypt.

Meanwhile, shipments to the pipeline's southern entry point appear as deliveries to Ain Sukhna in the northern Red Sea. While the vast majority of oil delivered to Ain Sukhna originates in Saudi Arabia, it also receives shipments from other countries in the region, including Egypt itself but also the United Arab Emirates and Iraq.

In addition to crude oil, Israel imports some intermediate (or 'dirty') petroleum products as feedstocks for further refining. A key product here is Russian VGO, which is regularly shipped from the ports of Novorossiysk and Taman on the Black Sea, likely for upgrading into jet fuel and diesel via hydrocracking. Like other supplies of feedstocks, this flow does not seem to have been affected by recent events, with four cargoes having reportedly arrived since 13 October 2023.

It is worth noting that flows of Russian VGO to Europe have been significantly impacted by a European Union ban on imports of Russian refined products which came into force in February 2023, with the resulting supply glut driving probable laundering via Turkey. As such, Israel's role as a consumer of Russian VGO is even more important now than usual, and buyers may have been able to secure better prices than in 2022.

US military aid

Israel continues to receive a substantial amount of JP-8 jet fuel from the United States in the form of military aid. Israel's key external source of military fuel — and of refined products in general — is the United States, which sends a Medium Range (MR) tanker of JP-8 jet fuel across the Atlantic and Mediterranean approximately every two months.

Prior to October, Israel received regular shipments of diesel from India's Jamnagar refinery. Since the Gaza invasion, this significant flow of refined fuel appears to have completely dried up, presumably as a result of the broader Red Sea crisis.

Since the invasion, Israel appears to have received three shipments of JP-8 jet fuel from the US. One left before the invasion, aboard the Overseas Santorini (IMO 9435909). Two appear to have been sent since the invasion, one aboard the same vessel and another on the Overseas Sun Coast (IMO 9862944), with the latest arriving in the first week of March. All originated from Valero's Bill Greehey refinery in Corpus Christi, Texas.

The best available evidence for the first shipment is via US bills of lading data, which shows it departing Corpus Christi for Ashkelon on 21 September 2023, and confirms that the exporter is listed as US GOVERNMENT DEFENSE FUEL SUPPLY.

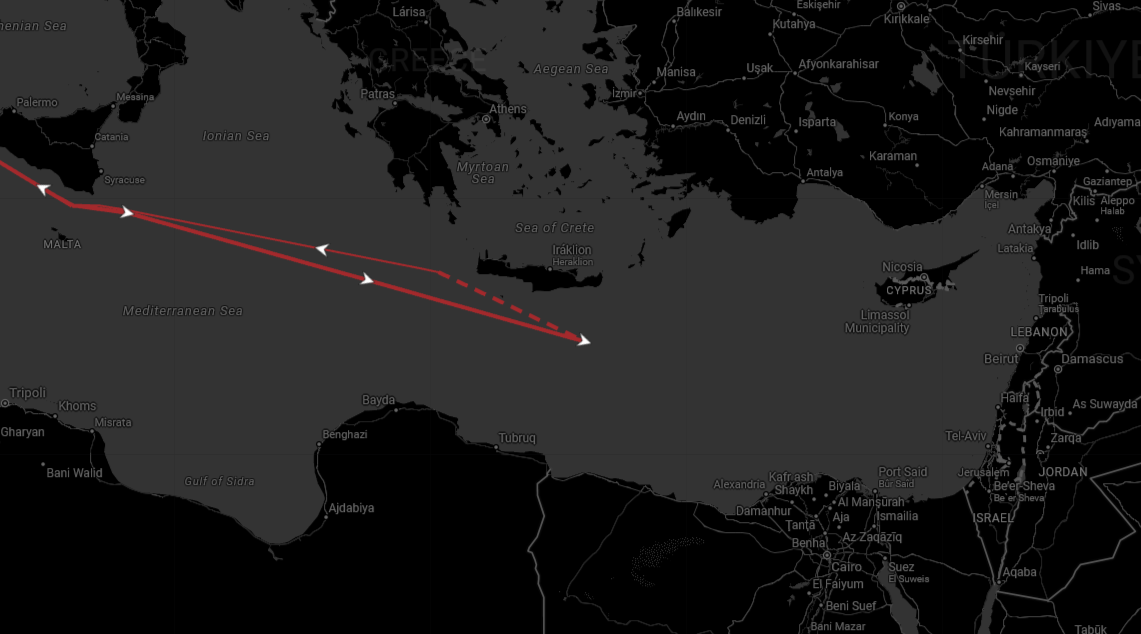

While AIS data clearly shows departure from the Bill Greehey refinery on 22 September, the tanker appears to have turned off its transponder on 19 October 2023, south of Crete, presumably to guard against rocket attacks from the Gaza Strip. As such, no data points are available showing the tanker actually docking in Israel.

A second journey appears to have been made by the Overseas Santorini almost immediately following the first, and also appears in the US bills of lading data. AIS data shows the ship departing the Bill Greehey refinery on 6 December 2023, with the signal lost in the Mediterranean just to the west of Crete on 28 December. On 4 January, the vessel reappeared near Cyprus, with its draught measurement significantly lower, consistent with having discharged cargo.

The third journey appears to have begun on 9 February 2024. The tanker called at Gibraltar on 27 February 2024, but without a significant change in its draught measurement being recorded, indicating that it did not discharge cargo. The Overseas Sun Coast's AIS signal was lost just to the east of Sicily on 2 March 2024, with the vessel heading east at 13.4 knots. A 6 March 2024 satellite image from Planet (below) shows a tanker matching the same description moored at the Number 2 Multibuoy berth at the EAPC terminal in Ashkelon. We understand that the shipment is, again, tagged as JP-8 jet fuel on a competitor platform to LSEG, although bill of lading information is not yet available via Sinoimex Global Trade Monitor.

According to the most recent available authorisation by the US State Department, from 2020, diesel and gasoline shipments are also part of the military aid provided by the US, but the bills of lading data doesn't show any shipments of diesel since March 2023 and shows no shipments of gasoline.

Involvement of international oil companies

International oil companies (IOCs) have significant involvement in Israel's crude oil supply chain. BP and Chevron are crucial to supplying Israel with crude oil via the BTC and CPC pipelines. ExxonMobil, Shell, Eni and TotalEnergies also have stakes in these pipelines and/or oil fields that supply them:

-

BP is the operator and largest shareholder in the BTC line (with minority partners Equinor, Eni, TotalEnergies and Exxon), while Chevron holds the largest stake among Western firms in the CPC. The BTC line carries a mix of crude from SOCAR and BP projects. The two largest shippers of oil through the CPC pipeline are Tengizchevroil — a Kazakh joint venture (JV) in which Chevron owns 50% and ExxonMobil 25% — and Karachaganak Petroleum Operating BV, another JV involving Eni, Shell, and Chevron.

-

According to LSEG's data, several BTC and CPC shipments since 13 October 2023 have been chartered by the trading companies Oilmar and Petraco, the latter of which has a an office in Guernsey. Citing anonymous sources, the trade publication Energy Intelligence reported in November 2023 that key suppliers of crude to Israel also included the international trading firms Vitol and Glencore.

-

While BTC oil is almost entirely from Azerbaijan, CPC oil is a blend made up of oil from major fields in and around both the Kazakh and the Russian sections of the Caspian Sea, as well as smaller onshore fields in southern Russia. The majority is Kazakh, and cargoes are given either a Kazakh or a Russian certificate of origin in overall proportion to the amounts of oil that are shipped through the system from each country (regardless of the exact composition of an individual cargo).

-

As the events of 2022 illustrated, the infrastructure for loading crude oil onto tankers at the Western end of the CPC pipeline is highly vulnerable to interference by the Russian government. That said, the importance of Caspian Sea oil and gas to US firms ExxonMobil and Chevron — and the lack of viable alternative export routes — has so far saved the CPC system from Western sanctions, and there is no reason to suspect that this will change in the near future. Similarly, while the Turkish government's stance on the invasion of Gaza has been hostile to Israel, it is unclear whether officials could intervene at Ceyhan to block specific shipments without risking damaging Turkey's relationship with Azerbaijan and its strategic position as a transit country for oil and refined products from Russia and the Caucasus.

-

Looking at shipments from Brazil, LSEG records deliveries of crude from the Berbigao, Sapinhoa, Tupi, Iracema Norte, Iracema Sul and Buzios fields in 2023 and 2024. Of these, the Berbigao, Sapinhoa, Tupi, Iracema Norte and Iracema Sul fields are all part-owned by Shell, while TotalEnergies also has a stake in the Berbigao field. Shell gained the assets through its 2016 acquisition of BG Group.

-

In Gabon, productive assets are owned by Perenco and a company called Assala Gabon following large-scale divestments by TotalEnergies and Shell in recent years.